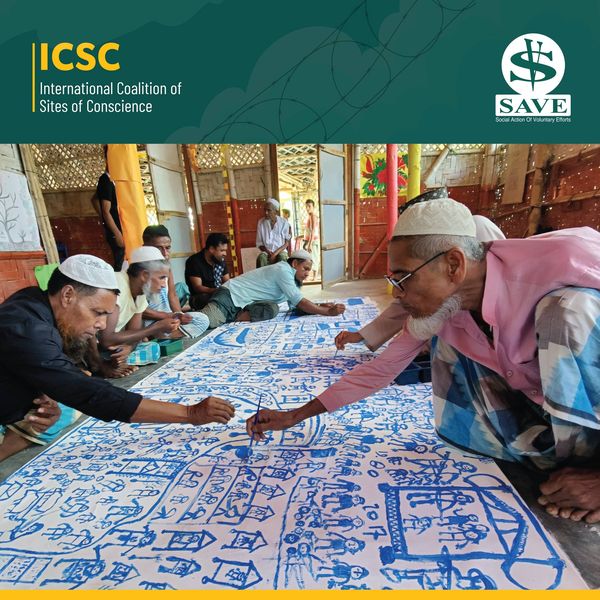

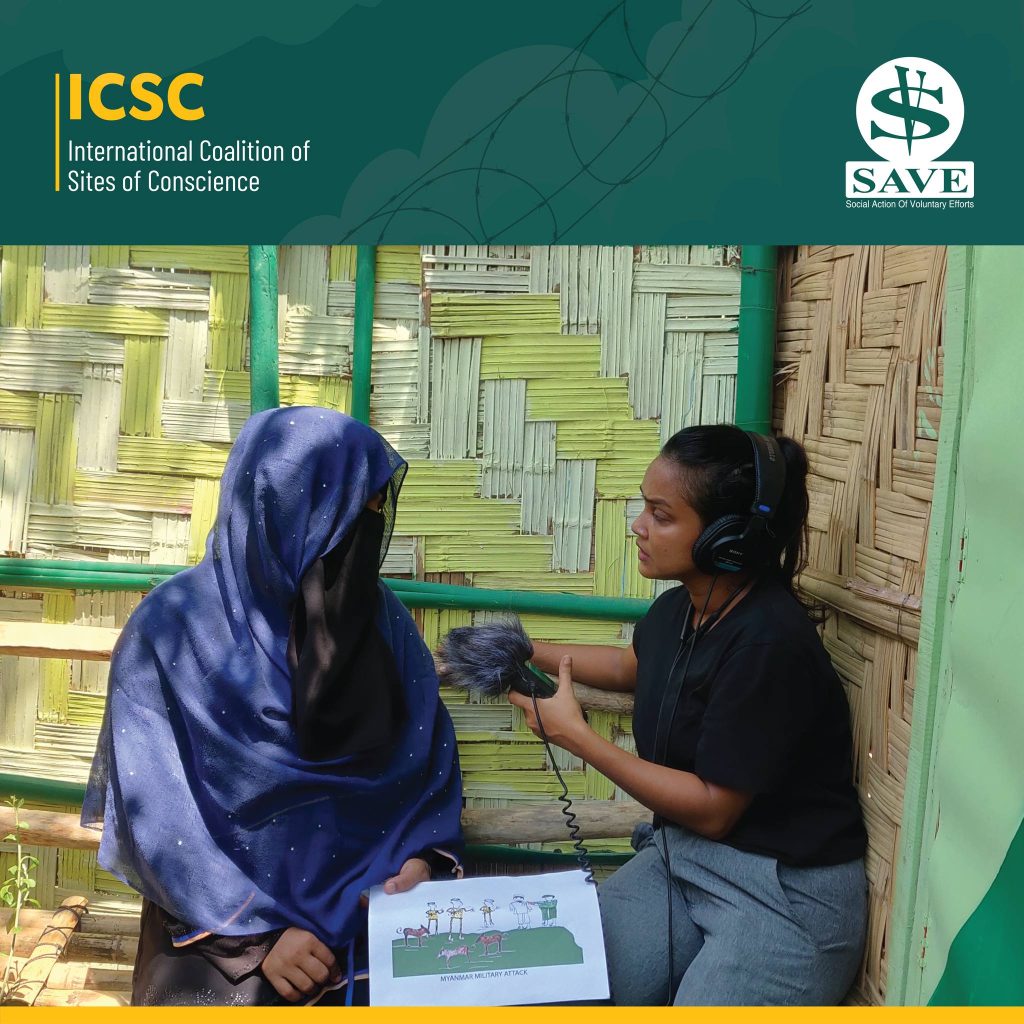

ADVOCATING FOR THE UNDERSERVED

OUR VISION

Building a Just and Equitable Bangladesh Since 2009

To make a just-full, equitable, capable and poverty-free Bangladesh, where every human being living with human dignity and free from all sorts of human rights violations, Eliminating hunger and malnutrition.

To create self-financed, self-employed, and self-empowered communities with increased capabilities by providing need-based services and supports.

To improve the quality of life of the poor particularly most disadvantaged women and children and community as a whole.

By providing need-based services and supports like education, health, income generation, microfinance, environment, Climate change, social security, etc.

Ms Bonney Rodricks

Executive Director

OUR programme

SEE NOW

Check RECENT VIDEOS

Social Action of Voluntary Effort (SAVE) has taken some interventions for COVID-19 during this period.

NEWS & EVENT

RECENT EVENTS

Stay updated with our recent events, where we highlight our latest initiatives, community projects, and impactful moments that showcase our ongoing efforts to create positive change.

Contact Us

Ms Bonney Rodricks

Executive Director

Cell: 01711-112075, Email: ED@savelkp.org

Md. Atiqul Islam Chowdhury

Deputy Executive Director

Cell: +8801711-574351 DED@savelkp.org

Drop a Line

Information :

info@save.org

Agency :

connect@savelkp.org

Join us in making a difference—connect with SAVE on social media, subscribe to our newsletter, or get in touch to learn more about our programs and how you can contribute to our mission.